Many dealer conversations are nearly identical. They all state they would expand their business immediately if only they could find the right people. They all recognize that the key to the success of their business lies in their people. What they often don’t see is the need to improve their hiring, training and retention programs in the store to find and retain the talent they want.

Before we go too far, you need to understand that turnover can be a good thing as well as a bad thing in your store. Every business experiences turnover.

“It’s the level and type of turnover that has the potential to create havoc for a business.”

Turnover can be a sign of dealership health -if it is low, predictable and in the right areas. A business without it is likely dying or stagnant and is most likely lacking energy and fresh perspectives. So, a complete lack of turnover is certainly a bad thing.

As most dealerships are always looking to replace the weakest player in the field, they expect turnover. But if it is too high, too centralized, or is made up of the top talent is detrimental to your dealership. So how do we calculate turnover and what should we consider?

Turnover rate:

Average the total number of employees who received a check every month for the last 12 months. (This is not an average of all employees employed during the year.)

- Count the total number of individuals who received a check in the last 12 months.

- Count the number of employees who received a check on the last regular pay cycle.

- Subtract C from B and you have your total terminations in the last 12 months.

- Now divide A by D times 100 to arrive at your turnover rate.

Now run the calculation again, but this time eliminate all closely related parties from your numbers. This would be you, your wife, child, sibling, and/or parents who are receiving paychecks, but are not going to be terminated. These individuals are artificially lowering your turnover rate because there are no turnover opportunities with those individuals.

Next, sort your employees by department and run the calculation based on variable operations, fixed operations, BDC and clerical. Does one department have a really high rate compared to another? Now sort your employees by job duties – sales, service advisors, BDR, and managers. Do you have a segment that is a problem? Last, sort your staff by voluntary (those that leave you) vs. involuntary (those that you terminate) termination and calculate the turnover on voluntary and involuntary.

What’s your number?

If your overall turnover rate is above 42.2 percent, it is higher than the national average for all employees in all industries. And it may be hard to believe, but that 42.2 percent is higher than the national average of all automotive in all positions.

Automotive sales positions generally carry the highest turnover rates, running about 67% according to a 2017 NADA Dealership Workforce Study.

Once you know your rates you can begin to look at the cost of turnover. Just like your dealership packs, where you have hard packs which directly impact the financial statement and soft packs which indirectly impact your financial statement, turnover can be broken down to hard and soft cost.

The Real Cost of Turnover

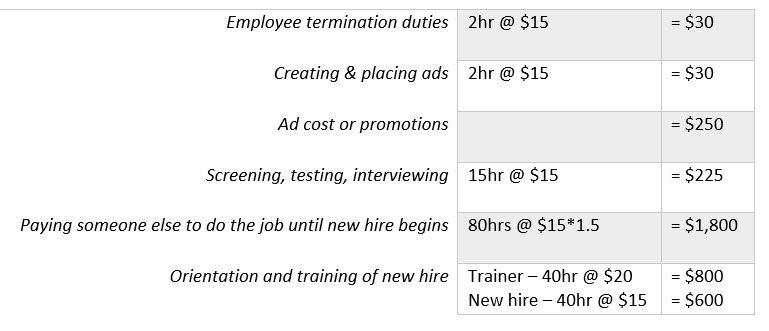

Hard costs include:

Based on the cost of the person doing this work at $31,000 per year and the person being hired at $31,000 per year and a slightly higher paid individual doing the training, you are going to have approximately $3,510 in hard cost.

Soft costs include:

Now, what about soft cost? Well, most human resource experts will agree that the minimum soft cost is two or three the amount of hard cost through lost sales, customer satisfaction, or productivity of other team members while the position is vacant. If it’s a management position it could be as high as six to nine of their annual salary.

Let’s be conservative for starters and assume your soft cost is $7,020 per new hire. Add that to your hard cost of $3,510 and you now have a cost per new hire of $10,530. Take the $10,530 times the number of terminations in your store for your cost of turnover in the last 12 months.

How would you like to bring a portion of that number back to your bottom line?

I’m not going to lie to you; you can’t bring it all back because as we stated earlier, a certain amount of turnover is expected and acceptable, so that means there is a dollar cost of turnover in every business. The real question is do you want to start managing your turnover cost and bringing a chunk of that turnover cost back to the bottom line?