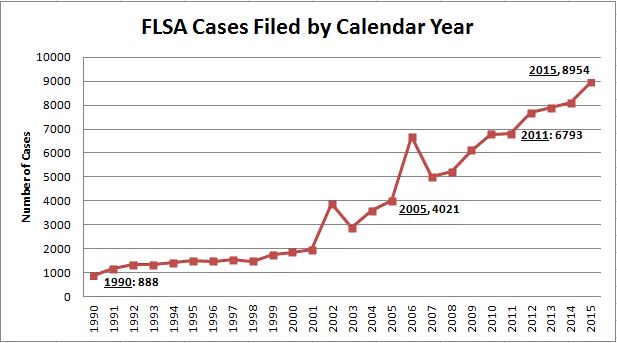

According to PACER, the number of lawsuits filed over wages continues to rise as seen in the chart below, which is based on federal court dockets. A rise of nearly 32 percent has occurred in just four years. This trend is expected to continue to rise over the next few years, especially in light of changes to the Fair Labor Standards Act (FLSA) that recently passed. Part of this increase is due to the aggressiveness of plaintiffs & plaintiffs’ attorneys who seek settlements for violations of workers’ rights under the FLSA changes.

Nearly 9,000 cases do not include any actions filed in state courts. When you factor those in, the number of items hitting the dockets is substantial.

If you want to stay awake at night, you can look at the type of class action suits that get settled related to wages https://www.lawyersandsettlements.com/settlements/employment-settlements/. Many dealers see these types of settlements and think “That won’t happen to me”. In reality, there are much more settlements that don’t rise to these levels but still have a significant impact on business. Any lawsuit is a distraction to your business in time, energy and money.

What are these lawsuits all about?

They are usually filed by attorneys on behalf of your employees who believe you have incorrectly paid them. This can be as simple as you shortchanged them on earnings or it can be a bit more complex in that they believe you misclassified them as an exempt employee when they should have been non-exempt. This misclassification may result in them not being paid for overtime worked. It can also happen when you misclassify someone as an independent contractor when they should be an employee. Regardless of the reason, they believe they are due more money from you.

The FLSA states that employees, without a proper exemption, working more than 40 hours in a given workweek must earn overtime. A work week is 168 hours straight and doesn’t have to be a calendar week. However, there are numerous exemptions to FLSA, some very specific to the automotive industry, that exempt employees from being paid overtime. Most dealers have used the exemptions correctly for years, but rules seem to be challenged regularly. If you don’t pay attention to the FLSA changes, you may find yourself underpaying your employee. If you are, you just might find yourself paying your employee and their attorney.

What do you need to do?

What you need to do now is review your compensation plans in light of the FLSA laws.

Make sure all employees are properly classified as exempt or non-exempt. If you’re classifying an employee as exempt, make sure their job duties, responsibilities, and compensation meet the criteria for exemption. Even with all of the exemptions that exist, there will always be several employees in the dealership who are non-exempt. Non-exempt employees could be porters, billers, business development representatives, lube techs and more. If you classify an employee as non-exempt, make sure you’re keeping accurate and consistent records of all time worked so you may pay them properly.

If you have a semi-monthly payroll, make sure you are double checking overtime calculations. Remember, overtime is based on the defined workweek of 7 days and 24 hours, not your pay cycle.

Last, but not least, if you pay your employees bonuses based on performance, and they are non-exempt and work overtime, make sure you are calculating all overtime wages correctly.

Why is this important?

The impact of violating FLSA rules includes paying two years’ worth of back earnings – three if deemed intentional. You could also be paying damages, which can be equal to or double the back pay, plus the attorney fees and court cost. In the end, it’s a smarter decision to pay your employee properly and keep their attorney out of your business.